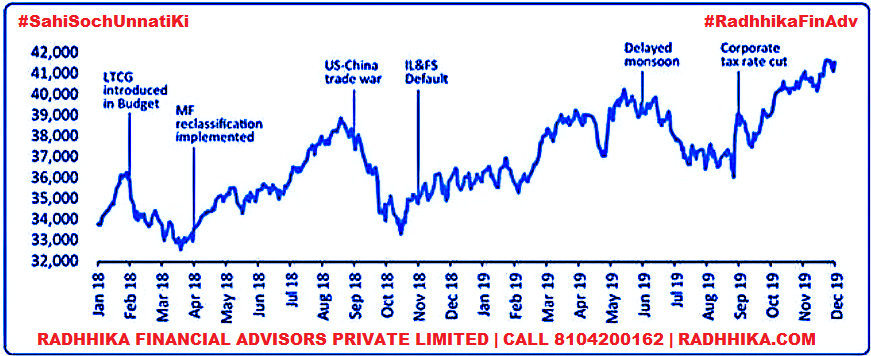

Market 2018 to 2019

BUDGET 2020: India Is A Big Story, That Isn’t Going Away For The Next 30 Years!

After a BIG victory of MODI, MODI – 2 started with big Bang-Bang of Tripal-Talaq, Section – 370 and RAM MANDIR, CAA issues, now they want to work, how we can reach towards $ 5 Trillion economy, AND as a part of going to become investment spot and manufacturing hub in the world, MODI- 2 provided big cut in corporate tax and we were witnessed a big up move in the market after that announcement. MODI – 2 had surprised everyone with many big reforms in India and that’s why, people of republic India had provided BJP the magic number of 303 sites in LS. After that, we have faced lower GDP growth of 4.50% but end of the year 2019 was little bit good as FIIs’ yearly investments figure crossed more than 1 lac corers in 2019, which was highest since 2014 after MODI won in 2014. People are very worried on lower GDP in all over India, but regards to GDP, as per me it’s all tactics or as a part of strategies of MODI -2 to keep lower GDP by lower government spending. As per the data since 1975, after every LS election in India we have faced a deep of around 0.80% to 1.20% in GDP growth since 1975. As per my view, it’s due to before Model Code of Conduct (आचार संहिता) and after the election results till the government stabilised, all political parties are focusing on elections and firm the government during those time of around 6 months. So these all worries on lower GDP are just to fight with MODI by oppositions only and public wants more tax cuts from government on name of slower economy and as a part of MODI, he wants to push and clear more and more big reforms on all these shouting and to make proper strong structure for future of BJP & INDIA.

If we look closely at the pattern as per the above market chart, they are not steady or not even stable. After, all the volatilities in stock market have produced positive returns in 2019. This data clearly proving that, we can’t ignore equity related products in now days. I feel sometimes, good time has to come for stock market as per returns wise, GOLD or REALESTATE both are not able to provide better than the equity in current market (and many others issues also like in Equity can start with small and liquidity issues,) that’s for the sure. So, we are as RADHHIKA FINANCIAL ADVISORS PRIVATE LIMITED, requesting to all of our investors who have not started working on their long term financial goals, to define their financial goals, like Children Educations and Marriages and make the proper financial allocation to achieve them on time and must understand their risk appetite if they are doing own individually.

Leave a Reply