Above title is from my old opinion (Click HERE) which I had published on March – 2016 for reference.

Sometimes market is laughing on bears right now… And, Bulls are hitting to bears very badly… “Bhāva Bhagavāna Chē” (Means Price is All (God) nothing else…

Follow the Trend

These above are some quotes from my old Opinion/Article. I remembered those days, that was the time around budget-2016. And, all people were bearish in stock markets due to same kind of economic situations. As market was moving up and up but no one have buying position or good chunk of holding in market. People were waiting for fall in market, market came down around 9% very badly for few days, but data can’t change in few days. At that time I was also on negative side by data but, after the fall of 9 % from High, no one had expected that kind of 13% up move from lower. And, that was the time of my new born as market researcher.

After that, I have never doubted on trends due to emotional view, but always checked myself to be with right trend of the market. So, this was the new Avatar of my thinking about market and data. After that, due to this kind of change in my thought process has developed a GROWTH MINDSET for me. It has provided lots of positivity in my own thinking and put one step forward into my own research and understanding about fundamentals and looking about it. Due to this GROWTH MINDSET, I got best performing stock of 2019 as RIL, 1st ever Large Cap stock of my career after starting own advisory firm. So far RIL had given tremendous results as per the returns wise & still my view is intact as per current performance for next 5-7 years.

And, this kind of GROWTH MINDSET is good in all humans as per me now. That’s the main reason to sharing this with you all.

Advisor for Investment

I believe that, after every 10 years, there will be a big difference in standard of living from past 10 years and after every 20 years there will be many big changes in economic front also. So we may face many challenges after 2020 and may going to enter in a new economy worldwide. So we need more flexible as well as trustful financial products. As we are facing currently all Life Insurance and MFs products are not appropriate. If, you have started investing in last 5 year than also, you have faced that, when I was starting this as a part of investment at that time I was not prepared for this kind of results. So this may be happening in future also again and again, you might be not prepared in future also. As many MFs’ schemes are not performing currently. That’s why many people are feeling “NIFTY IS MOVING BUT MY PORTFOLIO IS NOT MOVING AS SAME”.

That’s why also investors need dedicated individual as advisor. Currently many people are investing directly thru many “DIRECT OPTIONS” of investing, which is good if you are well versed with understanding about market and stock specific. But, sometimes we need to find someone trustful who can guide us on every steps of investing. Otherwise inflation will rise and you will not get returns as per banks or nor will get benefits of compounding also. You may save some money as brokerage but you may loss Returns on Investment (RoI) which has to come to you or may lose confidence for main concept of investment philosophy as you choose or bought something on wrong perception.

That could be, due to sales person who had sold you or your own decision to go with direct options for saving some amount of brokerages. I think people are taking lightly this kind of advisory due to bad experience in past. But in future EQUITY will be the best instrument for every types of asset class and necessity for everyone, as liquidity-wise, as per returns, as security and main thing as a growth wise. So, I am trying to explain what can be the right in some way of investing as investor has to take some steps before choosing advisor or some on investment part also.

Check Investment Performance on Time

In this case would like to explain by one scenario if, I am not running well from last 2 days, than I have to take advice from my family doctor. If I am not well after that advice also and not able to feel some improvement than need to take advice from big hospital and require to going for body check-up and proper reports also. Same like that do you think, do you have taken care as part of your investments? Do you ask ever that to yourself?

So, we need to understand that concept of investing is also important same as health, because health and wealth is correlated to each other. If you have money and don’t have health than there is nothing useful to you, more same if you are healthy but didn’t invest properly than also it’s not useful. We need to check our investment’s performance month on month and have to recheck investment instruments quarter on quarter or half year basis. If something is not performing than we have to check with advisor that, why this is not performing? And, need to check reasons behind non performance with your advisor, and come out with the restructure or preparation if require you and your advisor. So, our money can earn time-to-time for ourselves.

Goals based investment also requires check-up on time-to-time basis. Otherwise you may be running behind from your target time. I really feel that, Equity will be the best instrument from now onwards. As in all over the world currently, lower interest rates will be the key of that factor. People will not able to pay higher interest rates to loans because of lower margins and shrinking old economy.

There will be no stable interest rates for FDs to pay stable interest income to invest for retirements funds in future. And, as an investor we need to keep investing in good businesses which can provide us good wealth in future for us and our family. So, In starting, sometimes going slow on investment is understandable, but totally ignore for longer period is foolishness.

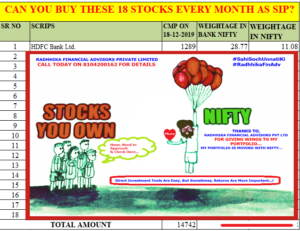

So We Are Providing One Snapshot Of Our Basket For SIP…

We Provide Customized As Per The Specific Goals & Requirements And …

We are currently hearing around us that, some downturns in economy in worldwide as well as in India also. GDP growth is below 5% lowest since 2014. But did you check that, why these FIIs are in actions? As last Jan-2019 month was a negative as per the FIIs flow, but from the Feb-2019 to till in just 11 months, the buying figure is more than 1 lac crores, and it has crossed highest level of 2014 the first time in India.

So, FIIs are bullish on India as per the data, but Indian public are waiting for down fall. As we all believe that, they have more strong research. So, Why we are out of the boat? If they believe that, India can do good from here, with MODI 2.0 and earnings will come today or tomorrow than, Why are we waiting for more people to come in same boat? If boat is empty or just few peoples are there than it’s good for us might be, Right? We can sit properly as per our choice or later as per the space… CHOICE IS YOURS!

As many MFs’ schemes are not performing currently. That’s why many people are feeling “NIFTY IS MOVING BUT MY PORTFOLIO IS NOT MOVING AS SAME”. So, Many looking to redeem as negative returns. But, next 6-7 months will be the best for start investments as per my personal view. Because, currently, all are waiting for fall in market, when some positive side will start after government’s efforts in economical interventions, from that time you have to give more time to your investments to come in positive for you.

Leave a Reply