Sectoral Focus As Per FPI’s Flow – 27th December, 2019

- FPIs stood net buyers for straight 3 months with Nov witnessing USD 3.14bn as against Oct which saw inflows to the tune of USD 2.2 bn. For CY19 FPIs have been net buyers of USD 13.7bn in the Primary and Secondary Equity market.

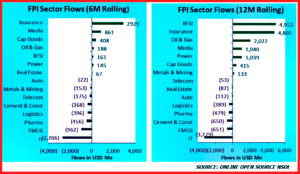

- Foreign portfolio investors (FPIs) bought stocks in BFSI segment worth USD 2.34bn in the month of Nov-19. ICICI Bank was in flavor on the back of MSCI wt up. Insurance sector has also been on the FPI buying list with USD130mn worth of buying seen in Nov-19 thus aggregating to USD 4.8bn in the last 12 months. The exposure to the Insurance sector by FPIs has exponentially moved from mere USD1bn in Oct-18 to a whopping USD10.5bn in Nov-19. Massive buying interest has been seen in names like SBILIFE, HDFCLIFE, IPRU and ICICIGI this year. Moreover all of these names have found way in global benchmark indices.

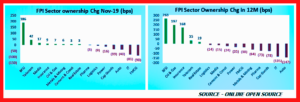

- BFSI saw FPI ownership increasing by a whopping 186bps last month and by ~263bps over last 12 months. Similarly in insurance sector, FPI ownership was up by 9bps month on month but a sharp 168bps over the last 12 months.

- BFSI saw FPI ownership increasing by a whopping 186bps last month and by ~263bps over last 12 months. Similarly Insurance sector FPI ownership was up by 9bps over the previous month and a sharp 168bps over the last 12 months.

Leave a Reply